Invest Real Money with Social Trading Networks

Social investing is the newest phenomenon to capture the imagination of retail traders across the globe. Social trading’s proclaimed aim is to promote transparency by enabling investors from around the world to copy each other’s trades, learn from each other and make real money online. Some new subscribers to these networks are relatively inexperienced traders who are attracted by the prospect of sharing in the success of a trading guru by copying his or her trades to make real money online. Others want the chance to shine in the light themselves and become the superstar on a social trading network as their winning trades are published on the website, attracting a growing army of followers. If you are contemplating becoming part of a movement dubbed the ‘Facebook of investing’, realmoney.co.uk weighs up the key essentials to consider.

| Casino |

Rating |

Highlight |

Bonus |

Trusted Link |

Terms and Conditions |

| etoro.com |

5 ★ excellent |

- Leading Social Trading Network

- Trade Online With Confidence

|

0% Commission On Stocks |

Trade Here |

Trading involves a high risk of loss. T&Cs Apply |

| collective2 |

5 ★ excellent |

- Top Performing Investors

- Leading Platform Connecting Investors

|

Free Demo Account |

Trade Here |

Trading involves a high risk of loss. T&Cs Apply. |

How to Find the Best Social Trading Network

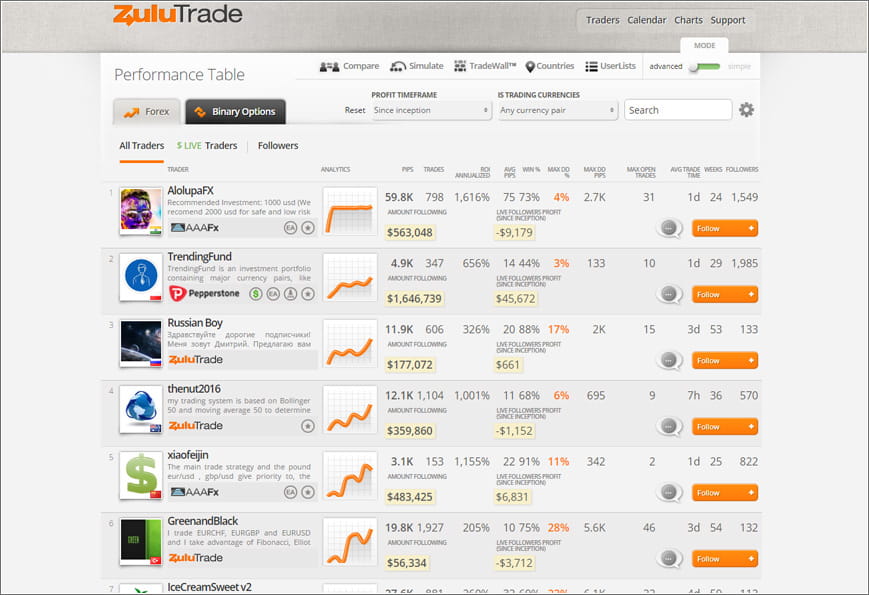

One of the principal benefits of social investing is that you get to share in the wisdom of crowds. While you should always be guided by your own intuition – and investment research – the trading ideas that come to mind when surveying markets at your desktop PC can be tested against the prevailing sentiment of other investors. Social trading networks provide a great way of doing this. Some provide users with a dashboard that displays where the predominant buying and selling activity is. Here you can also see the copy trading strategies that have generated the most returns and the biggest followers in the social trading network.

Still, it is the capacity of social trading networks to allow investors to copy the trades of the website’s star performers that is driving their appeal. Before social investing took hold, investors had to trawl internet forums and message boards to get useful tips from their peers. Social trading networks now offer a supervised forum for the exchange of trading ideas and tips. The desire to share the flow of information is given a platform. The verification processes that users must comply with in order to register and the investing track record each user builds up provides the foundations for an investment community. This contrasts with many forums where strangers online interact with each other.

As social networks such as Facebook, Twitter and Instagram grow in popularity, investment networks such as eToro also appear destined to attract more subscribers. Etoro, the world’s biggest social trading network, has grown rapidly in size and now has more than 4.5 million users since it was founded in 2007. If you are already an active retail trader, joining a social trading network could be a good way of diversifying your portfolio. As the thought processes of an investment ‘guru’ on such networks will differ from your own you have the chance to branch out into different types of trading strategies.

Key Essentials for Social Trading

The growing interest in social investing has resulted in increasing numbers of brokers entering the fray and offering real money trading services. In weighing up which provider to choose you should check if there is a demo account available. As you will probably be new to social investing, it is better to practice trades and follow so-called investment stars with virtual cash – rather than real money first. A key feature that you should look out for is the historical investment track record of the network’s star traders. How far back in the past does a network let you check on its guru’s trading history? The longer a guru’s trading history is recorded, the more reliable his or her credentials will be. If you only see a very fleeting snapshot of a so-called investment star’s trading history his stellar performance could be more a result of luck rather than genuine investment skill. It is wise to choose a social network that has already built up an army of followers rather than a newbie to the scene. Newcomers by their very nature are unproven. If a new social trading network’s offering does appeal it could be a better idea to keep an eye on it until the network becomes more established, building up a good user base.

- Simply Follow The Top Ranked Traders

- Copy Trades From Succesful Traders

- Attract & Increase Your Own Followers

- And Make Extra Profit With Them

As with any broker, if you use a social trading network that offers Contracts for Differences (CFDs) on securities you should check to see if the spreads offered are competitive. Also look out for any additional account management fees or charges on trading inactivity that may apply. If you follow a fund or star trader you may also have to pay a monthly fee for the privilege of copying the trades. Some social trading networks require a minimum investment that can start at about £8,000.

Boost Performance with Social Investing App

If you don’t yet trade on your smartphone or tablet device perhaps you should seriously consider doing so. If you decide to take the plunge and add social trading to your investment portfolio, you should make sure that the network offers a leading-edge mobile trading app on which to trade. The key functions that you should look out for in a mobile trading app include the availability of a demo account, a copy trader function, access to a full range of markets including Forex, commodities and indexes. Live market rates, a full suite of analytical and charting tools and the capacity to adjust your leveraged exposure. In addition to a comprehensive range of features, an app should also be intuitive and easy to navigate. A trading screen on a handheld device needs to be cut down to the core essentials needed for making a trade rather than being crammed with data and functions. You should also check if the app is compatible with Google Play’s Android operating system or Apple’s iOS operating system.

Avoid the Scam Operators

If you have little experience with real money online trading or social investing represents a new investment terrain for you, make sure that you carry out your own due diligence checks before making a cash deposit with a broker. Unscrupulous rogue outfits are targeting unwitting investors with promises of bountiful returns only to defraud them of their trading deposits. Make sure that the social trading network is fully regulated and authorised to provide investment services in the UK under the remit of the Financial Conduct Authority (FCA). Also check the customer service options that are available. Many brokers are now offering a live online customer support chat function. Also, check if a telephone customer support number is available along with a postal address to make written inquiries.

Risk Warning:Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. Trading in financial instruments may not be suitable for all investors and is only intended for people over 18. Please ensure that you are fully aware of the risks involved and, if necessary, seek independent financial advice.